Car insurance policy for a 17-year-old driver is not low-cost; there's no method around that. One reason automobile insurance is much more costly for teenagers is that they have minimal experience behind the wheel. Auto insurance business understand this and charge policy owners extra for teen-driver coverage. However, there are some things you can do to conserve money on your teen's auto insurance policy.

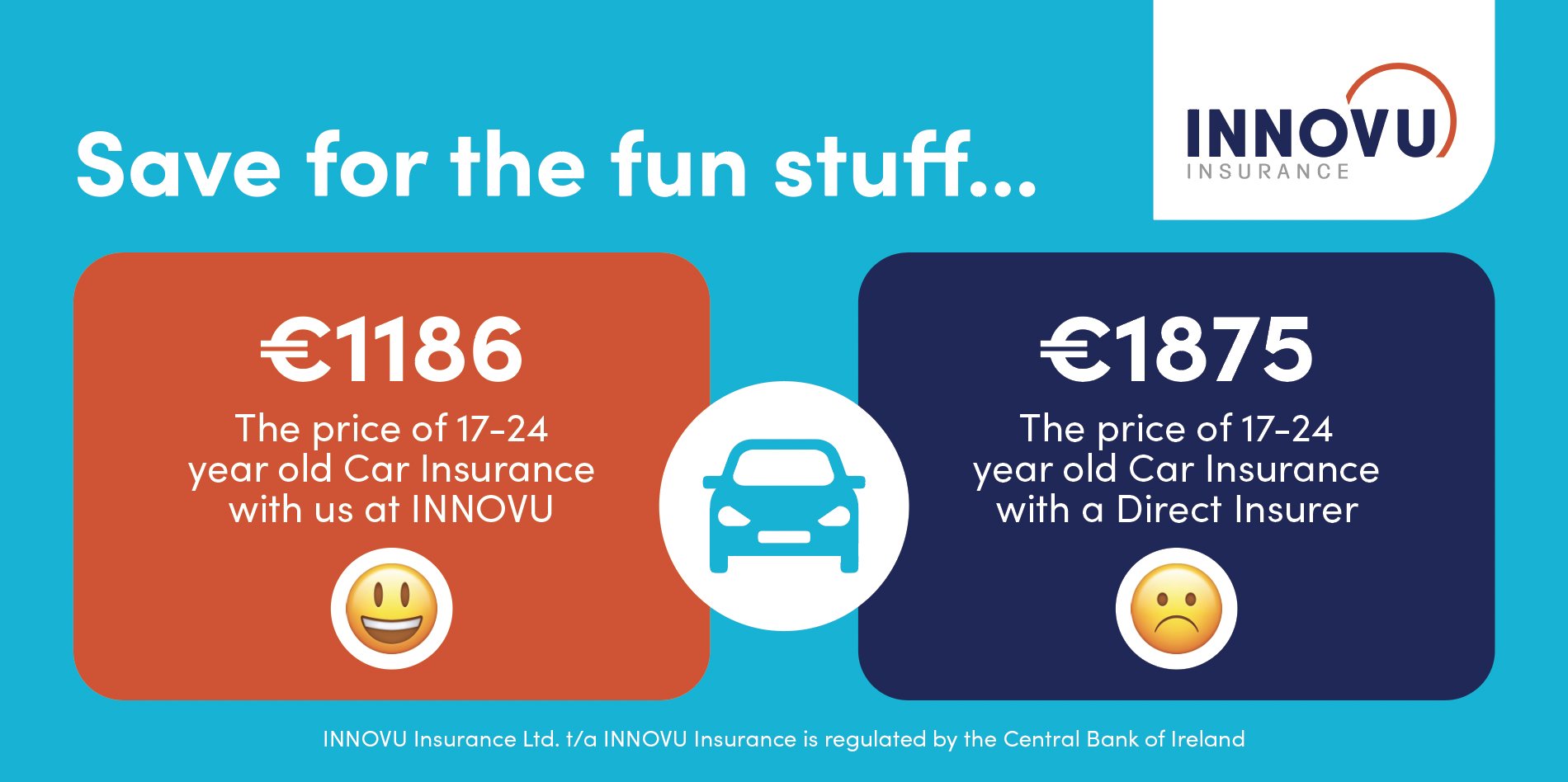

In addition, male teenagers receive even Check over here more driving citations than female drivers. This causes higher crash rates and insurance cases amongst male teens. Yearly Auto Insurance Policy Rates for Men and Females, Typical Yearly Premium$2,940 Ordinary Yearly Costs$3,338 Rates for males are:$398 more, This is 14% more costly. Least Expensive Car Insurance Provider for 17-Year-Old Drivers, The most effective method to save money on automobile insurance is to search.

The most costly was Nationwide, with an increase of $928, which converts to $3,751 to include a teen to your family policy. That's an increase of regarding 25%. insurers. To discover the least expensive auto insurer for 17-year-old vehicle drivers, we considered figures from business that write policies in at the very least 30 states, so you may or might not have better success with a local company in your location.

cheap insurance cheap vehicle insurance cheapest

cheap insurance cheap vehicle insurance cheapest

Compare quotes from the top insurance firms. If it's not possible to add your teen to your plan, the rate for an individual plan for a 17-year-old driver is a lot higher. State Farm had the least expensive quote at $3,213 standard, as well as Progressive was by much the most pricey, with a whopping $7,353 average.

Scroll for more Automobile Choice Matters When Insuring a Young Motorist, The sort of vehicle your teen drives will certainly additionally influence rates. A Ford Mustang might be what your teen has their heart established on, but insuring a Mustang is quite pricey about $1,400 more than guaranteeing an extra sensible Toyota Camry, which equates to an increase of regarding 44%. car.

How Car Insurance For Teens - Root Insurance can Save You Time, Stress, and Money.

It's even much better if they can drive the family members vehicle unless the household auto is a racy sports automobile. Including a 17-year-old to your family policy would be cheapest via Geico, at a typical $2,823 annually - insure. The most affordable policy for a teenager of the exact same age obtaining a specific policy would certainly be at least $3,213 usually with State Ranch, yet maybe greater with various other companies.

Auto insurer base their rates on their customers' driving background - car insurance. Because teens don't have a substantial driving history, they're an unknown entity to the insurer. This causes greater rates. Even if your teen is a very secure chauffeur, there's not adequate driving history for the insurance provider to assess.

Comparison buying amongst carriers might save you as much as 50% over the most costly provider. The Insurance Details Institute recommends getting quotes from at the very least three business before you resolve on one. insurers.

cheaper car business insurance cheaper auto insurance business insurance

cheaper car business insurance cheaper auto insurance business insurance

Display Your Teenager Vehicle Driver to Make Sure a Clean Driving Record, If your teen vehicle driver gets involved in an accident or gets a citation, your prices will increase rather a little bit. low cost. For instance, if your son obtains one speeding ticket in The golden state, your premium could rise by an average of $1,242.

insurance company prices cheaper car insurance laws

insurance company prices cheaper car insurance laws

As parents, you may occasionally ask yourself if your teenager is focusing on anything you say, yet they are. Below are some points you can do to advertise secure driving with your teen: Design great driving habits yourself. Allow your teenager drive while you function as the passenger whenever possible. Limit the variety of teen passengers they're enabled to drive with.

How Understanding Teen Car Insurance Rates - Safeco Blog can Save You Time, Stress, and Money.

Defensive driving courses can likewise supply a price cut, although you ought to check with your insurance policy business due to the fact that some companies do not supply this. On the various other aid, a protective driving training course for your teen is a good idea anyway, due to the fact that it will certainly provide them even more experience behind the wheel (affordable car insurance).

Lower the Insurance Coverage Amount, You could decrease your insurance coverage amounts to conserve some cash in the short run, although this is not a strategy we would certainly recommend. For something, that teen chauffeur you currently carry your car insurance plan might enter a crash. If your teenager completes your car, you'll need to either repair service or change it out of your pocket.

If you have a finance on it, the money company will certainly require that you have complete insurance coverage. If you have paid-for, less costly autos, you may be able to get by with liability-only car insurance policy, however it's still a risk. You can additionally take into consideration enhancing the deductibles on your policy. Just make certain you can cover the new, higher deductible to ensure that you're not in a bad financial circumstance if there's an accident.

Luxury vehicles are also pricey to guarantee, mostly since the expense of fixing is greater. The difference in price in between including your teenager to the household insurance if they drive a Toyota Camry vs. a Ford Mustang has to do with $1,400 (business insurance). Impress upon them that teens are most likely to enter crashes and that a showy cars is something they can obtain when they have more motoring experience, when they can manage it as well as when they are no longer on your insurance (auto).

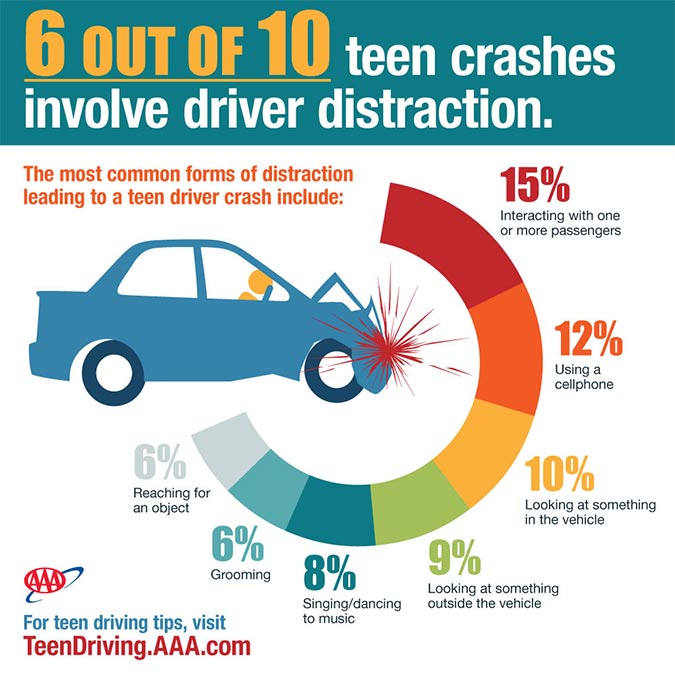

They're not used to making fast decisions in traffic, as well as they're not as experienced at checking out other driver's purposes. Driving takes practice to become good at, as well as some motorist's education courses only offer a few hrs of roadway experience prior to trainees test for their licenses. Integrate this lack of experience with much less maturation as well as some overconfidence, as well as it's very easy to see why 16- and also 17-year-olds are most likely to get involved in crashes.

The Best Guide To Auto Insurance For Teen Drivers - Allstate

5 times more likely to obtain into a crash the initial month they have their permit contrasted to teenagers with at least a few years of driving experience. Vehicle drivers who are 16 or 17 years old are nearly twice as likely to obtain right into a crash as teenagers who are 18 and 19.

We located prices varying from a low of $704 average in Hawaii for a teen contributed to their State Ranch policy to a high of $6,674 in Louisiana with State Ranch. car. Generally, auto insurance coverage is much more expensive in Louisiana, so it would make good sense that insurance coverage for teens is also much more expensive - insurance companies.

Method, Cash, Geek accumulated information for 17-year-old chauffeurs to identify the ordinary price of car insurance coverage. Standards are based upon picked inputs for average vehicle drivers in details states. We utilized the same driver accounts throughout all states - auto insurance. See a lot more on our approach web page. Learn more on Automobile Insurance Policy, Auto Insurance Policy, Vehicle Insurance Policy, Regarding the Writer, AAA Structure for Web Traffic Safety And Security.