Deductibles Impact Just How Much You Pay For Car Insurance, This is only the expense of your deductibles. Another pair of primary auto insurance costs to bear in mind are your premiums. The partnership in between your premiums and also deductibles is straight domino effect in the globe of vehicle insurance. A greater auto insurance deductible limitation can lead to lower costs, while a lower insurance deductible restriction can raise your monthly costs and the total cost of cars and truck insurance. perks.

Currently, allow's say that you raise your insurance deductible to $250. A deductible limit of $500 would result in reduced month-to-month vehicle rates of $129 - vans.

insurance affordable vehicle insurance vehicle insurance insurance

insurance affordable vehicle insurance vehicle insurance insurance

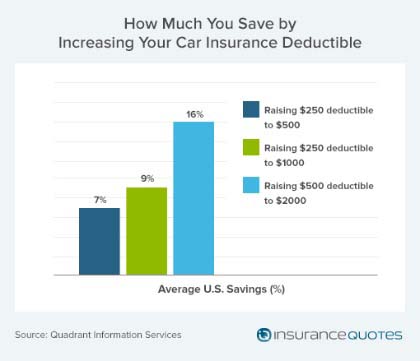

Like, upping your deductible from $1,000 to $2,000 may just conserve you around 6%, while $500 to $1,000 can save you up to 40%. There are some deductibles that aren't worth it. When is an Automobile Insurance Policy Insurance Deductible Paid? What determines whether or not you'll need to pay a deductible is the condition of the vehicle damages as well as what car insurance coverage strategy you make use of to cover it.

What does allow you to pay deductibles prior to the vehicle insurance business covers the fixing expenses are: - Obligation coverage will not enable a deductible for repair work to damages sustained in a mishap that was the fault of another driver. credit. Currently, if you were at fault for the accident and problems, then damages to your automobile would certainly be covered by your collision plan, which allows deductible usage.

Car Insurance Deductibles - How Do They Work? - 21st.com for Dummies

After filing the auto insurance claim, you would be able to pay your deductible. - In no-fault states, whoever created the accident to begin with isn't vital as well as requires vehicle drivers to carry no-fault or individual defense auto insurance. This covers injuries and also damage to your cars and truck - vehicle insurance. You pay the personal protection insurance deductible when you submit your vehicle insurance claim.

The other driver would cover you. However, if your damage exceeds their very own auto insurance coverage limitations, you may have the ability to pay an insurance deductible towards it. When Isn't an Auto Insurance Coverage Insurance Deductible Paid? Paying an insurance deductible is required for 2 out of the 3 plans for full auto insurance coverage crash and also extensive.

vehicle credit score vehicle insurance

vehicle credit score vehicle insurance

Perhaps you do not want the insurance deductible quantity subtracted from your insurance payout. laws. If that holds true, here are a pair of methods you can avoid paying your insurance deductible if undesired: - As stressed throughout, if you are struck by an additional motorist, after that their responsibility auto insurance coverage would certainly cover the costs of your repairs and also injuries - business insurance.

- In a scenario where you have to pay your deductible yet do not desire to, you might be able to function out something with the auto mechanic. They would certainly bill your automobile insurance coverage company sans the deductible quantity while you set up a layaway plan - cheapest car. The mechanic may hold your cars and truck until the insurance deductible is paid. affordable car insurance.

What Is An Auto Insurance Additional reading Deductible? How Does It Work ... Can Be Fun For Everyone

- While it differs with vehicle insurance coverage business, you might be able to forgo your deductible when you submit a case. The technician or vehicle store will bill your insurance coverage company without the deductible.

Rather of replacing them, they repair them, provided that the damages isn't also extreme. You won't need to pay a deductible to your auto insurance policy supplier. insured car. Ideal Method For Establishing Your Deductible, When making the choice on what your vehicle deductible quantity ought to be if you ever before need to sue, there are numerous elements to consider.

At the very same time, it helps to think of what your personal spending plan allows. Below's what you ought to take into consideration about your vehicle insurance when setting your deductible limit: - A vehicle insurance deductible is paid by the insurance policy holder out of pocket. Beginning by asking on your own if you're able to pay $500 or $1,000 at any kind of provided moment considering that accidents do take place.

- With your deductible, believe about just how much your vehicle insurer will certainly payment after you file your claim. Would certainly a greater month-to-month automobile premium deserve the reduced deductible, or the other way around? - If an additional driver (with car insurance) is accountable for any damages, then you don't have to pay the deductible because it's the various other driver's insurance coverage covering it (cheaper car insurance).

7 Easy Facts About How To Choose The Best Car Insurance Deductible - Jerry Shown

So, the month-to-month costs may be a little much, yet that means that the deductible is low. Most motorists of rented cars pick lower deductibles that offer more coverage. - There isn't simply one kind of insurance deductible. Each strategy, like extensive as well as crash, has its own insurance deductible restriction that you get to set. auto insurance.

They're able to establish their crash deductible lower or greater than their detailed insurance deductible. Vanishing Insurance Deductible Discount, A vanishing deductible is an insurance coverage choice where the insurance holders pay a charge for lower deductibles whenever a case is filed. cheaper cars.

At the same time, it's straight symmetrical to your regular monthly prices. There are additionally a pair of methods you can save money on those rates by searching or bundling other kinds of insurance coverage with a particular business - auto insurance. While it is a good concept to reduce your deductible if you desire much more insurance coverage, it's not the best training course of activity to increase them if you want your car insurance coverage to be less expensive.

credit score trucks car insurance low cost auto

credit score trucks car insurance low cost auto

Selecting an automobile insurance coverage deductible can result in extreme monetary ramifications if not done right. Deductibles are indeed a resource of complication and also irritation for lots of people, especially thinking about the range of choices readily available. credit score. It's challenging to choose whether to go for a high premium or high deductible with car insurance coverage.