In the majority of markets, when you're not to blame for an accident, we can forgo the deductible if we can identify the various other event, that they're at fault, and their insurance policy provider verifies they have valid obligation insurance coverage for the mishap. vehicle insurance. This investigation can take time, so the deductible might use at the beginning of the insurance claim and also be reimbursed later on.

Your deductible just applies when your insurance policy firm spends for your vehicle repair services. There is no insurance deductible if the various other celebration's insurance coverage is managing the repair work. The insurance deductible only relates to your own vehicle repairs. There is no insurance deductible for the other event's automobile repairs under your plan. Your claims service rep will send you a compensation check for your insurance deductible.

If you utilize the common gas mileage price, you can not subtract vehicle insurance coverage costs as a separate expenditure. You can still subtract tolls as well as parking fees. This includes cars and truck insurance and the other items provided above. If you're uncertain which one you intend to make use of, or which might let you subtract much more, it may assist to assess the mileage deduction regulations.

However, several people make use of a personal car for both individual and also organization functions. To identify what puts on your taxes, you'll separate the expenses in between personal and service usage based upon the miles that you drive. As an example, if 70% of the miles you drive are for service, as well as the other 30% are for individual, you'll normally be able to apply 70% of your expenditures to your deduction.

Locate a Store Enter ZIP code to locate a shop near you. cheap insurance.

The Ultimate Guide To Why Do Insurance Policies Have Deductibles? - Investopedia

"Recognizing Automobile Insurance Policy: Leading The Way" is the 7th video in the Reserve bank of St. Louis series, "No-Frills Money Abilities." This episode utilizes a radio talk show layout to explain various aspects of automobile insurance. credit. From the actions to concerns from callers, trainees learn numerous essential concepts and also terms connected to cars and truck insurance coverage.

If you are at-fault in a mishap, the insurance company will only pay for the damages to your vehicle IF you have actually purchased accident coverage. A deductible amount is applied initially, after that the insurance policy company pays.

Hello there? Hi? Carol, you'll need to turn your radio down. Oh OK sorry (cars). So my inquiry is; if I acquire accident insurance for when I harm my very own auto, as well as I buy liability insurance policy for when I harm a person else's auto or cause injury. What happens if someone hits me, I'm injured, and also they do not have insurance coverage? Carol, there are methods to secure yourself.

If you've already experienced a claim, you have actually most likely learned how your deductible works initial hand. For those who have not, it can create complication about just what an insurance deductible is as well as that pays for it. What a deductible is A deductible is the amount of cash you (the named guaranteed on the plan) pays out of pocket for the price of problems before the insurance coverage company pays.

affordable auto insurance prices car affordable

affordable auto insurance prices car affordable

Your insurance policy firm will certainly pay the continuing to be balance of $500 to the garage. Since you have actually chosen a $500 deductible, you will certainly be accountable for the expenditures.

The Basic Principles Of Auto Insurance Deductible - Rogersgray

It's not part of the premium. When you pay your insurance coverage premium, you aren't adding to a financial savings account versus future losses (perks). While the quantity of your deductible can raise or decrease your premium, deductible as well as premium are 2 various things. It's not something that the insurance coverage business pays. The called guaranteed on the policy is responsible for paying the insurance deductible quantity.

This indicates that also if a person else was driving your cars and truck and entered a mishap, your insurance provider would manage the case and also you would be liable for your plan insurance deductible. It's not the like a medical insurance deductible. Deductibles for medical insurance plans usually cover an entire 12 months, indicating you would only compensate to the amount of your deductible (i.

Nonetheless, a vehicle insurance policy deductible applies "per occurrence." This means you are responsible for your complete insurance deductible amount each time you endure a covered loss - affordable car insurance. Just like all points insurance, it's best to talk about deductibles and also how they use in your circumstance with a neighborhood independent insurance policy representative. Your regional independent representative has the understanding as well as experience to answer often asked questions regarding deductibles and compute cost financial savings for you depending upon the deducible quantity you pick.

Discover what an automobile insurance coverage deductible is as well as just how it impacts your car insurance protection. auto insurance. Automobile insurance most of us recognize we need it. But beyond that, a number of us still ask ourselves, "What vehicle insurance policy should I get?" The trick is knowing what deductibles and also insurance coverages are as well as how they affect automobile insurance.

What is a deductible? In other words, an insurance deductible is the amount that you consent to pay up front when you make an insurance policy case, while the insurer pays the rest approximately your insurance coverage restriction. When selecting your cars and truck insurance deductible, consider just how much you want to pay of pocket if you require to make an insurance claim.

The smart Trick of How To Choose Your Car Insurance Deductible - Kelley Blue ... That Nobody is Discussing

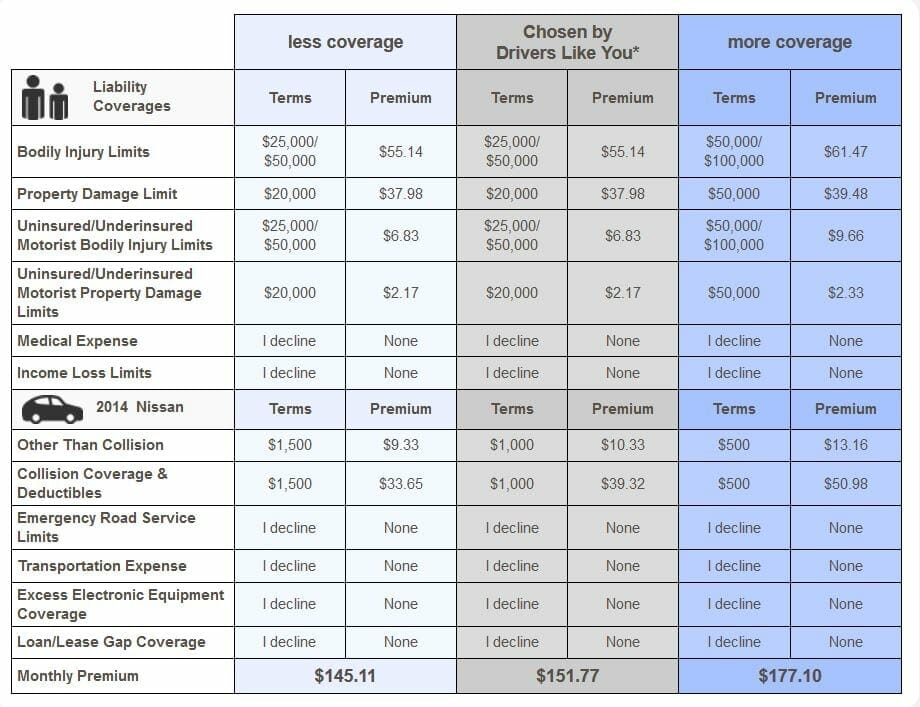

It truly boils down to what makes you the most comfortable. Auto insurance coverage typically contain several type of protections. Because insurance laws vary from one state to another, the adhering to info is here to offer you a broad summary of regular coverages, and it isn't a statement of contract.

Uninsured driver This insurance coverage pays for problems if you or another covered individual is wounded in an auto crash triggered by a driver who does not have responsibility insurance policy. In some states, it may also pay for residential or commercial property damage.

It differs by state and also relies on policy arrangements. Underinsured vehicle driver insurance coverage goes through a policy restricts picked by the insured. Rental repayment This protection pays for rental expenses if your vehicle is disabled as a result of a protected loss. Daily allocations or limits differ by state or policy provisions.

A deductible is what you pay out of pocket to fix your vehicle prior to your cars and truck insurance pays for the remainder. If you carry comprehensive and accident insurance coverage on your cars and truck insurance, you will certainly see a deductible detailed on your plan as a buck quantity.

When do you pay your insurance deductible? You only pay the deductible for fixings made to your very own vehicle.

The 10-Second Trick For Who Pays For My Deductible After A Car Accident? - The ...

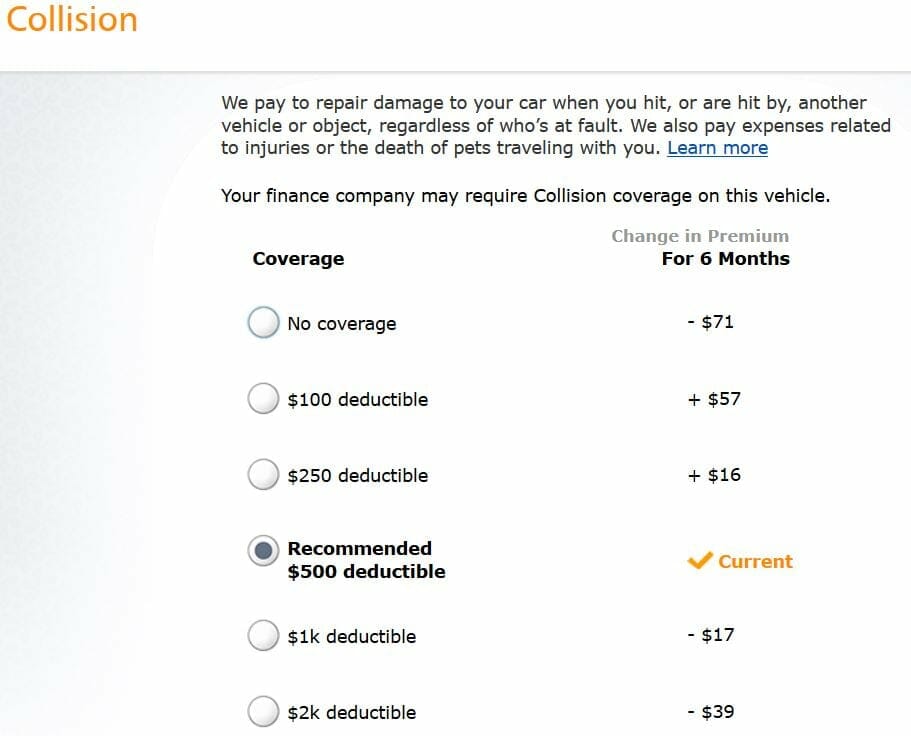

This is where the worth of your cars and truck can be a big factor. cheaper. For that reason alone, you may see a large cost jump in your costs if you go with the lower deductible.

If you're still leaning towards a greater deductible, believe regarding this: Just how long would it take to redeem what you'll invest on premium costs? If it's just going to take you a year or 2, the higher deductible might still be looking excellent. Or else, the lower deductible might make even more sense - insurance company.

Think concerning how you use your vehicle. If you live in a quiet area with a short commute to work, you may be comfy with a greater deductible. cheaper car insurance. Be certain and talk to your ERIE agent to help you figure out which plan is best for you.

The cash we make assists us provide you accessibility to complimentary debt scores and records and assists us produce our other wonderful tools as well as academic materials. Payment might factor right into how and where products appear on our Additional resources platform (as well as in what order). However given that we typically make cash when you find a deal you like and also obtain, we try to show you offers we think are an excellent match for you.

Certainly, the deals on our system don't represent all monetary products out there, however our objective is to show you as several fantastic alternatives as we can (cheapest car insurance). Overwhelmed concerning how a car insurance coverage deductible jobs? When shopping for automobile insurance coverage, you'll likely stumble upon words "deductible" and also could wonder how it influences you as well as your insurance coverage expenses as well as when you'll in fact require to utilize it.

Examine This Report about What Is A Deductible? - Sonnet Insurance

Usual automobile insurance deductible quantities are $250, $500 and $1,000. Allow's state you skidded into a guardrail, submitted an insurance case that was accepted as well as took your vehicle to the body store for fixings. Repair work amounted to $5,000, and you have a $500 deductible. The insurer would offer the body store $4,500, and you would certainly need to pay the various other $500 to the store when the repair services were completed (low cost).

vehicle liability car insurance automobile

vehicle liability car insurance automobile

An automobile insurance deductible isn't a solitary amount that you pay every year prior to services are covered, like you'll generally find with health and wellness insurance deductibles. Basically, it relies on where you live (auto). In a lot of states, if you're in an accident that's the various other vehicle driver's fault, their obligation insurance coverage is normally in charge of covering your repair services, approximately the coverage limitation.

An auto insurance deductible is the amount you consent to pay of pocket for a case prior to your plan pays the remainder. Maintain reading for more information regarding car insurance policy deductibles, including: Exactly how an automobile insurance coverage deductible works Some kinds of vehicle insurance policy require you to pay a collection quantity expense prior to the plan covers the remainder of the claim.

The damage is covered under your crash insurance policy, and the repairs appear to $7,000. If you have a $500 deductible, you pay $500, after that your vehicle insurance company pays the remaining $6,500 (cheap). When do you pay a deductible for cars and truck insurance policy? Not all kinds of auto insurance need you to pay an insurance deductible.

: covers damage due to factors aside from collision, consisting of theft, criminal damage and also fire. An uninsured/underinsured vehicle driver insurance case might have an insurance deductible, depending upon where you live. Uninsured vehicle driver coverage deductibles tend to be regulated by your state rather of you choosing the amount. Car obligation insurance covers damages and injuries you trigger to other individuals or their residential or commercial property.

Michigan's Auto Insurance Law Has Changed - Questions

Do I pay a deductible if I'm not liable? If you remain in a crash that is not your fault, you usually will not pay a deductible. This is because you would certainly be submitting an insurance claim against the at-fault motorist's vehicle insurance coverage. Nevertheless, the process of determining that is at mistake might take some time.

You will need to pay your insurance deductible in this circumstances, yet if it's later discovered that you're not at mistake for the accident, you can get a refund (cheaper car). There are a couple of various other possibilities that might happen: Your insurer might decide to seek activity versus the other motorist's company to recover their expenses.

cars liability cheap insurance cheap auto insurance

cars liability cheap insurance cheap auto insurance

cheaper car insurance cheap insurance cheap cheap auto insurance

cheaper car insurance cheap insurance cheap cheap auto insurance

If you are unable to redeem your insurance deductible from your service provider, you can take the various other chauffeur to tiny claims court for the deductible amount. Maintain in mind, nonetheless, that the deductible amount may unworthy the time. Auto insurance policy deductible vs. premium Deductibles and costs are two kinds of payments you make to your vehicle insurance provider for insurance coverage.